2025 Year in Review: A Historic Market Year for Investors

2025 Year in Review: A Historic Market Year for Investors

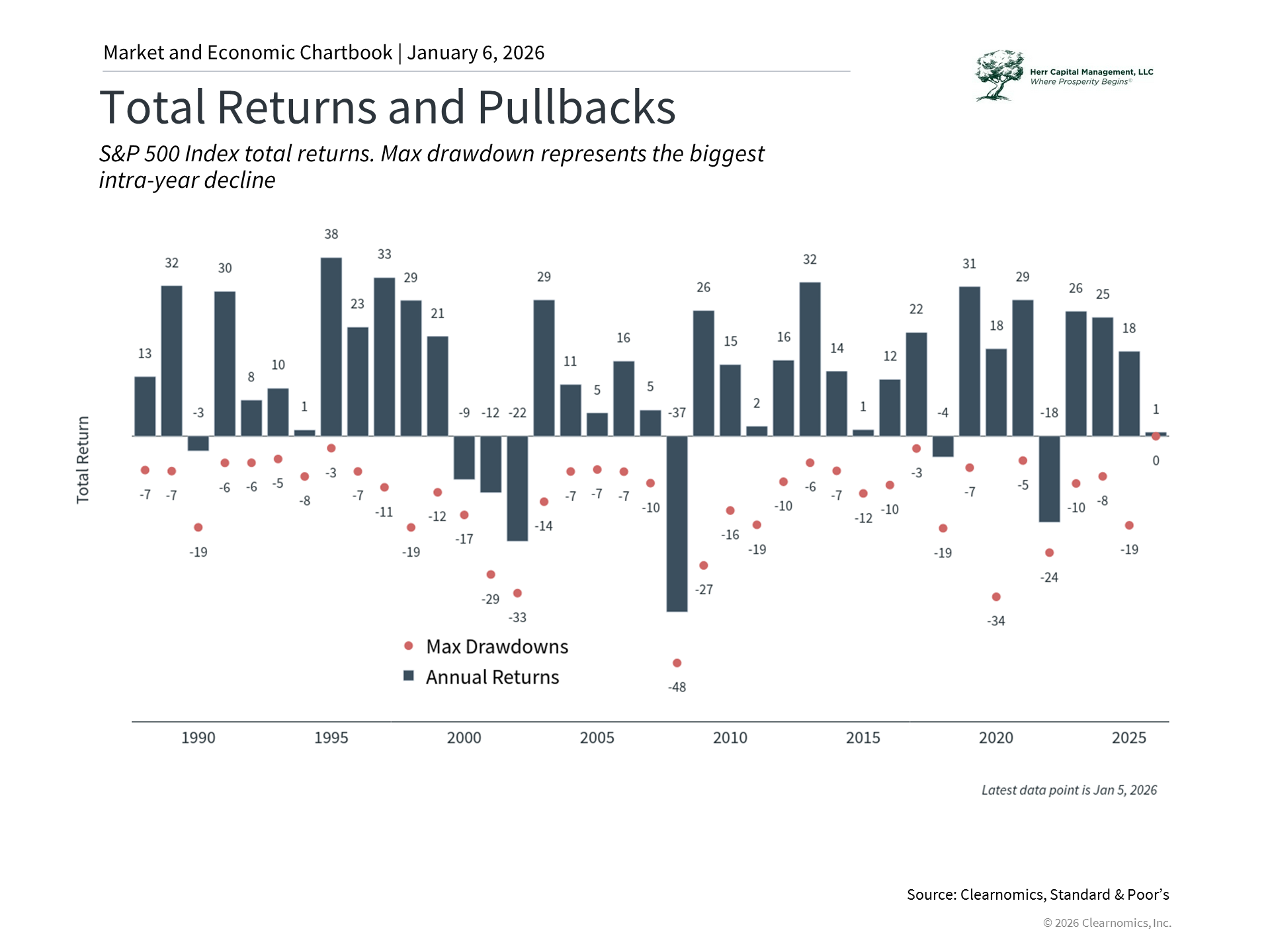

2025 was a historically strong year for markets despite the many events that took place along the way. The past year delivered no shortage of headlines including April's tariff announcements, ongoing developments in artificial intelligence stocks, the passage of the One Big Beautiful Bill Act, and more. Yet through it all, investors are likely happy as U.S. stocks rose to new record highs, international markets outperformed, and bonds continued their rebound. The S&P 500 has now generated double-digit returns in six of the past seven years and has nearly doubled in value since the market bottom in 2022.

The past year reinforces the lesson that the best way to weather uncertainty is to remain disciplined and focused on long-term goals. As we look ahead to 2026, understanding what drove markets last year can help investors navigate the challenges and opportunities that lie ahead.

Key Market and Economic Drivers in 2025

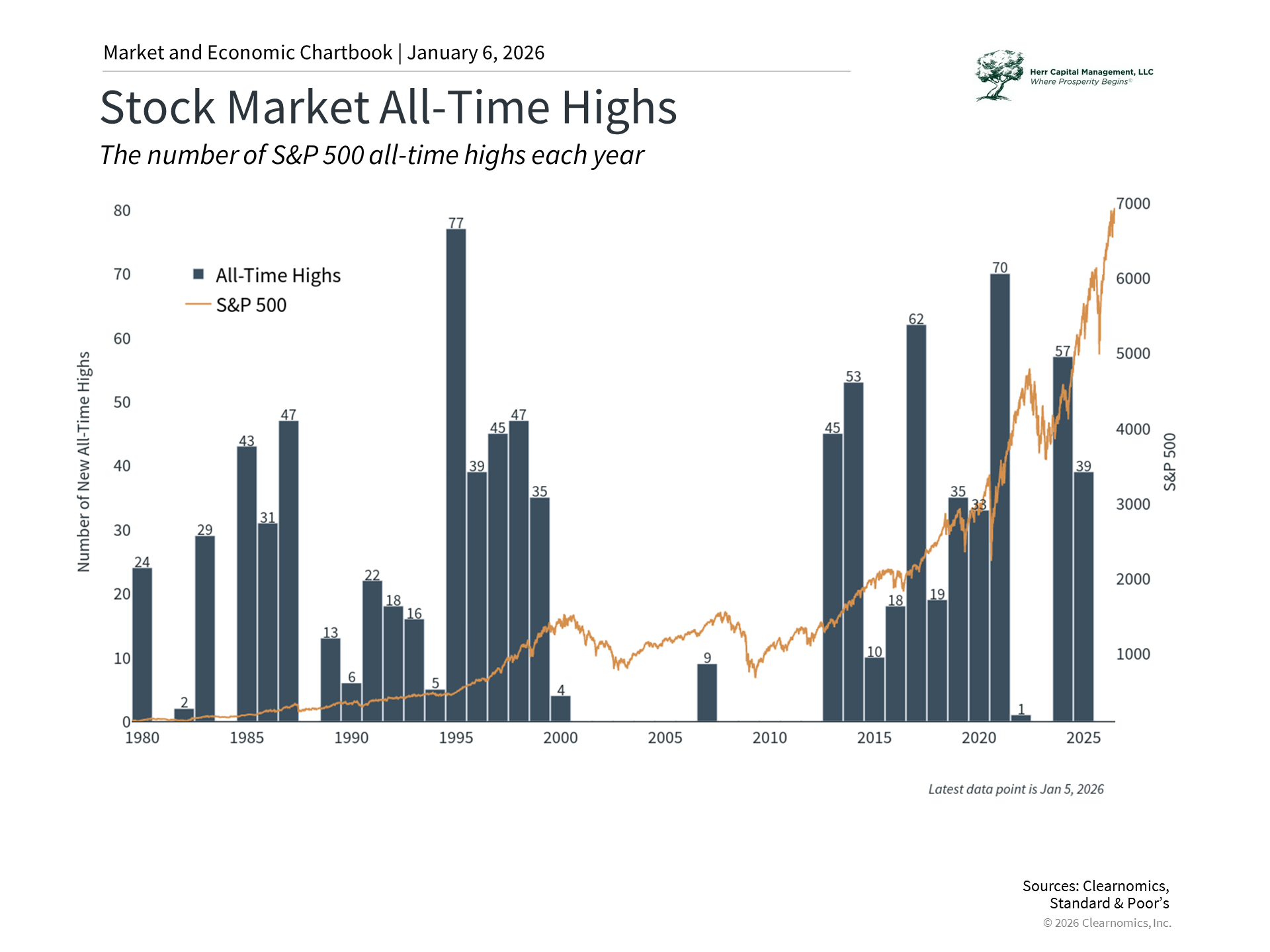

- The S&P 500 gained 17.9% with dividends in 2025, achieving 39 new all-time highs. The Dow Jones Industrial Average rose 14.9% and the Nasdaq returned 21.2%.

- The VIX, a measure of stock market volatility, remains low by historical standards, finishing at 14.95 after climbing as high as 52.33 in April.

- The Bloomberg U.S. Aggregate Bond Index gained 7.3%, its best performance since 2020. The 10-year Treasury yield ended the year lower at 4.17%, down from 4.57% at the start of the year.

- International developed markets and emerging markets each gained over 30% in U.S. dollar terms based on the MSCI EAFE Index and MSCI EM Index, respectively.

- The U.S. dollar index ended the year at 98.32, falling 9.3% from 108.49 at the beginning of the year. The dollar reached a low of 96.63 in September.

- Bitcoin experienced a decline of about 6.5% from $93,714 to $87,647, after rising as high as $125,260 in October.

- Gold prices rallied throughout the year, finishing at $4,341 per ounce for a 64% gain. Silver prices also rose to $70.60 per ounce from $29.24 at the start of the year.

Major events in 2025

|

Many of the events of the past year were “known unknowns.” This concept was made famous by former Secretary of Defense Donald Rumsfeld, who distinguished "known unknowns" from "unknown unknowns." For investors, this distinction can be helpful since the former are uncertainties we can anticipate. When markets react to these events, investors can be prepared in advance and avoid being caught off guard.

Concerns around tariffs, for instance, were very much on investors’ radars ahead of April 2. While this didn’t diminish the market reaction due to the size of these tariffs, it did allow the market to rebound quickly once events played out. Investors also knew the Fed would likely adjust rates once the job market weakened. Many also expected a new tax bill to pass given that Republicans control both houses of Congress.

Even concerns around AI, which are perhaps the biggest uncertainty for markets today, have also been at the top of investors’ minds. While the DeepSeek moment in January, when a Chinese AI company showed that models could be created and run more cheaply, was unexpected, the parallels to the dot-com boom and past surges in capital expenditures by large companies are well understood.

|

To summarize the major market-moving events over the year, here are the top 10

Three key themes defined the past year

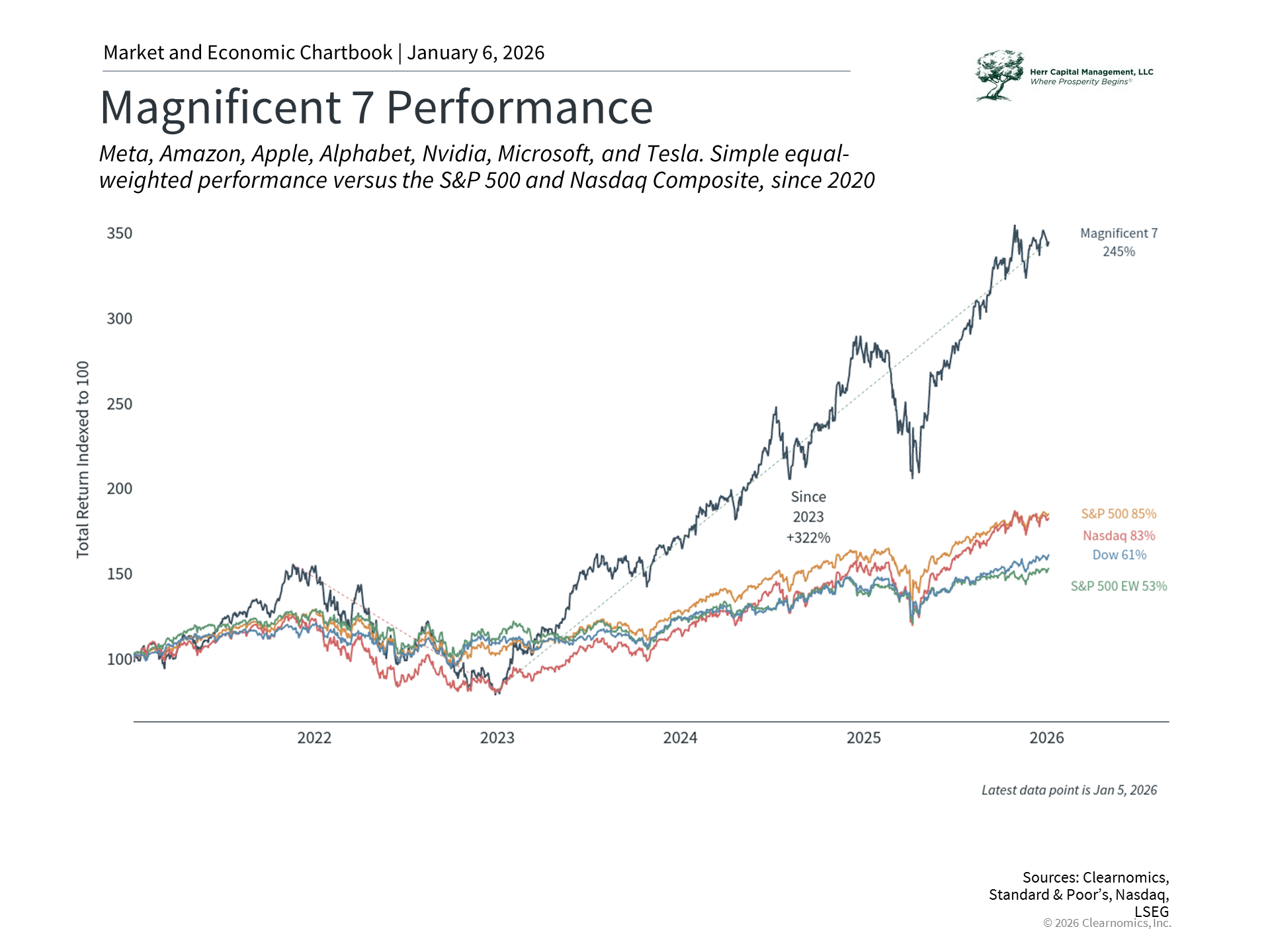

What themes drove markets across these events? First, it’s hard to miss the fact that artificial intelligence dominated market narratives throughout 2025. From massive infrastructure investments to concerns about market concentration, AI grew as an important source of economic growth and market returns. The Magnificent 7 stocks now represent around one-third of the S&P 500, creating concentration risk that means most investors have exposure to these stocks whether they realize it or not. Recognizing this when crafting investment strategies and financial plans will only grow in importance.

Second, tariff policy created uncertainty but has had less economic impact than expected. Tariffs on imported goods have risen sharply for many trading partners, yet the feared economic consequences largely failed to materialize. This is because companies adapted, tariffs were paused or scaled back, and consumer spending remained strong. For investors, this highlights that the outcomes of policy changes in Washington, whether its trade or federal finances, do not always have an obvious effect on the economy or markets.

Third, many asset classes performed well in 2025. International stocks outperformed U.S. markets, due in part to the decline in the U.S. dollar. Bonds generated strong returns and have nearly recovered their losses from 2022. Other individual assets including gold also had record years. So, benefiting from all of these asset classes is less about making individual investments, but about having the right asset allocation that can take advantage of opportunities while managing sources of risk.

The bottom line? 2025 was a strong year for investors. While we celebrate a good year in markets, it underscores the importance of maintaining investment discipline. Investors should continue to apply this lesson to their investment and financial plans for the coming year.

What's Happening With Us?

This past quarter has been an exciting one for Melissa and Terry! They met up in Denver, to attend Charles Schwab’s 35th IMPACT conference. IMPACT is the nation’s largest and longest running gathering of independent financial advisors. These three days in November were filled with non-stop education, connection and growth.

This past quarter has been an exciting one for Melissa and Terry! They met up in Denver, to attend Charles Schwab’s 35th IMPACT conference. IMPACT is the nation’s largest and longest running gathering of independent financial advisors. These three days in November were filled with non-stop education, connection and growth.

Melissa and Terry heard from industry experts, analysts, and fellow advisors, and even connected with the next generation of financial professionals. Schwab’s mentoring program was a highlight, Melissa was honored to be selected as a mentor. She was paired with Jayvyn, a senior at the University of Illinois at Champaign, who will graduate in May 2026 with a degree in Financial Planning. Jayvyn came prepared with plenty of questions—and got a bonus, because Melissa and Terry always come as a team! He’s excited to begin his career with Schwab in their Florida office after graduation.

One of the keynote speakers was renowned author and leadership expert Simon Sinek. Fun fact: Melissa asked Simon what his favorite book is. His answer, “I’ve only read one book, The DaVinci Code.” He stated, he doesn’t read due to severe ADHD. Simon views his ADHD not as a disorder, but as his superpower. He joked that instead of reading, he can just call an author and interview them on his podcast. To top it all off, Melissa and Terry walked away with a fun new caricature, courtesy of an artist at the Northern Trust booth.

Herr Capital Management, LLC is a registered investment advisor domiciled in Illinois.

This content is for information purposes and should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney, financial or tax advisor or plan provider. Products or services mentioned on this Site will not be made available to persons resident in any state or territory where such distribution would be contrary to local law or regulation. Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.